Your Value Proposition Has Little Value

I was reviewing some advisor websites the other day and I was confused by some of the value propositions that I read.

Here’s some of them…

“Total transparency”, “value first”, “client obsessed”, “making finances simple”

One firm had their staff photos prominently displayed with bios containing phrases like “craft beer enthusiast”, “lover of musicals”, “lifelong learner”, “experience seeker”, and get this… “Swiftie (Taylor Swift fan)”.

What on earth?

It struck me that this marketing approach is well-intentioned and might be meaningful to the firm, the assumption is that they’re equally meaningful to the prospect.

They’re not.

They fall on deaf ears.

Why?

Because people don’t care about your business, they only care about their problems.

But as I put myself in the shoes of these firms, what they’re attempting to do is portray themselves as being “not your typical advisor”.

By using feel-good high concept buzzwords (which come from the corporate world), or portraying yourself as average everyday people, the idea is to become more approachable, likeable, non-threatening, and unlike typical advisors… because these qualities are supposed to differentiate you and make you attractive to potential clients.

But that’s a flawed idea because of two major reasons:

1.) Most other advisors attempt to do the same

2.) The customer has already categorized you, because the advisory business has become commoditized

Ironically, claiming that you’re different in a space where everyone else is claiming to be different as well, makes you appear just like them.

And trying to portray yourself as “average everyday people” is what other advisors are also claiming that makes them “unique”.

It’s important to realize that before you even meet a prospect, they’ve already made assumptions about you based on the problems they need solved.

If it’s a medical problem, they’re looking for a serious medical expert.

If it’s a financial problem, they’re looking for a serious financial expert.

Differentiation is not about being different for its own sake.

Differentiation is about how much trust and authority you project in terms of the problem your client needs solved.

It’s about being able to articulate your ideal client’s problem more clearly and more directly than any other advisor.

Clarity generates trust, and being able to trust you (not necessarily like you) is the only value proposition your clients really care about.

In the highly competitive and commoditized advisory industry, it’s super critical that you learn to embody this truth in your business.

Consider these three important strategies:

1.) Fall out of love with your business

Instead, fall in love with the depth of your prospect’s issues. Your prospects don’t care about your business or your team. They only care about their problems. They care less about how you solve their problems, they care more about but whether or not they can trust you to solve it (important difference).

2.) Avoid business trends, jargon, and buzzwords

These only have currency in the corporate world but are too abstract and disconnected from normal people dealing with normal challenges of everyday life.

3.) Focus deeply on your prospect’s problems

During a sales conversation, most advisors don’t always listen well, instead, they’re waiting for their chance to offer solutions. By re-orienting yourself around your prospect’s problem and leaving out any mention of the solution entirely, it’s possible to eliminate multiple meetings and get paid clients in one singly meeting only.

If these suggestions sound like common sense, unfashionable or impossible, your prospect sees things very differently than you.

The more clearly and directly you can differentiate yourself, based on your prospect’s problems, the more you become a trusted authority — the only choice for them.

If you're an ambitious advisor, with a defiant streak (following the crowd isn't your thing), who is overly reliant on referrals, with limited time and resources, but willing to grow and challenge your own thinking -- and you'd be happy with 1 – 2 new high-net-worth clients per month...

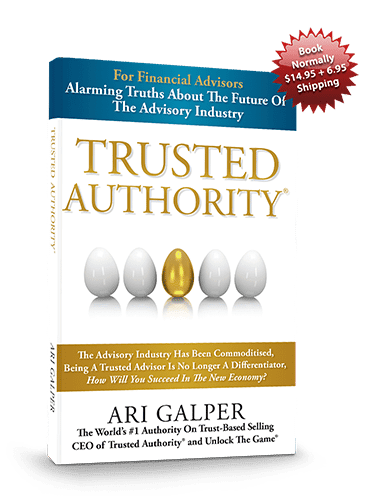

Get Your Free Book & Free "Get New Clients" Sales & Lead Generation Consultation ASAP!

Order the new book “Trusted Authority” below and get a free “Get New Clients” sales & lead generation consultation (value $995.00).

In this ground-breaking new book, you’ll discover:

- How to create a flow of high-quality leads in the next 90-days by becoming the Trusted Authority in your market

- How to differentiate yourself from other advisors so that your ideal client says “He/she is the one for me…”

- How to re-position yourself to create inbound demand for your ideal clients only becoming a “category-of-one”

- How to create a “by-appointment-only” business so you stop lowering your authority by "chasing” leads

- How to onboard new clients in one single meeting or zoom conversation… yes this is possible!

Meet The Author

Ari Galper is the world’s number one authority on trust-based selling and is one the most sought-after sales conversion experts for Financial Advisors.

He is the creator of Unlock The Game®, a completely new revolutionary sales approach that overturns the notion of selling as we know it today.

Ari has been featured in CEO Magazine, SkyNews, Forbes, INC Magazine and Financial Advisor Magazine – and has been a featured speaker at the Financial Planning Association’s national conference.

His newest book, “Trusted Authority”, has become an instant best-seller among Financial Advisors worldwide.

With clients in over 35 countries, his global sales systems have become the most successful Trust-Based Selling systems of our time.

In a day and age where technology rules the selling world, for many growth-oriented advisors, deep trust has taken a “back seat” to the sales process.

Ari’s personal insights on how to build trust between buyers and sellers continue to break new ground in the financial services industry.

Ari has been on a mission for the last two decades to change the financial services world through trust.

Through his sold-out talks all over the world and his in-house trainings for high-producing advisors, Ari has become the global ambassador to businesses all over the world.

He regularly connects with global business icons and leaders of industries seeking his counsel on how to infuse trust in their organisations and across their teams.

Ari is a true “disruptor” in the financial services industry. He has been endorsed by legendary sales mentors like Brian Tracy who said: “Ari Galper’s trust-based selling approach is the greatest sales breakthrough in the last 20 years”.

Ari’s sales growth consulting firm has a growing waiting list of financial advisors wanting access to his unique Trusted Authority lead generation models and sales conversion strategy advice.

Ari is also the author of “Lessons From Toby”, a special book about his son Toby who has Down’s Syndrome, who has made a major impact on Ari’s approach to teaching authenticity and trust in his Trust-Based Selling approach.