The End Of The Discovery Meeting

The discovery meeting in an advisor’s sales process has always been considered unchallengeable.

Why?

Because for years, even decades, advisors have been taught to always include these components inside the initial meeting with a prospect:

– Relationship building (or rapport)

– Fact finding

– Showing value

– Illustrating potential solutions

– Asking the prospect to bring their financial documents to a second meeting to review

The rationale behind the last step is to develop a financial plan from those documents and for the prospect to review the plan in the hope they’ll engage you to continue handling their portfolio.

There are two issues with this:

1.) The process can break down when your prospect goes away to retrieve their documents and never does, forcing you to pursue them

2.) Assuming they bring their documents, you’re then doing all the upfront planning work for free, with no guarantee you’ll be paid

I want to challenge this idea of free planning and the entire process itself.

The truth is that if you simplify your sales process to one single meeting focused only building deep trust (not rapport building), your prospect will happily pay you for your planning process.

You’re probably thinking that building trust is the whole point of the discovery meeting. But my idea of trust is very different to what most people think of when they hear that word.

The closest example that illustrates this best is how a doctor approaches their intake process.

Doctors don’t dispense medicine to their patients, they provide them with a treatment plan or the prescription for the medicine and they get paid for that, it’s not free.

In fact, the pharmacy won’t even sell the medicine without a doctor’s prescription.

In the medical industry, the prescription and the medicine, are viewed as one and the same, in the overall paid treatment process.

The financial plan you prescribe for your prospect (their treatment plan) and the services required to implement that plan for them as your client (their medicine), should also be viewed and presented as one and the same.

Many advisors do all of that treatment planning work up front for free, hoping it will convince their prospects to become their clients to “get the medicine”, almost like it’s a separate event.

This is where the discovery meeting sales process falls over.

A doctor’s process works because of its simplicity and clarity. To solve your problem you pay for the treatment plan first and then the medicine. There is zero confusion about that and so trust is built in from the beginning.

The steps involved with the typical advisor’s process creates complexity and work for the prospect, so that the path to solving their problem becomes complicated and laborious, which makes them question it’s value.

If you eliminate these unnecessary steps in the discovery meeting and focus on building trust only, you can get paid from the outset for your process (not your solution), because it will have made the value of engaging you clear from the beginning.

I actually call this approach to selling the “One Call Sale”.

It’s about a mindset shift that needs to happen around simplifying your sales process, so that you can onboard somebody into a committed monetary relationship from a first meeting.

I know that sounds like a radical and even scary idea, but it’s only because most advisors are conditioned to using the selling norms engrained in their industry.

But once you realize how these norms are getting in your own way and you can refocus your process to deliver to your prospects what they really need (which is clarity around solving their problem), then engaging you from a single first meeting will feel natural and logical to them.

If you can simplify the complexity in your sales process by eliminating the normal steps (discovery meeting, document retrieval, financial plan, review meeting, for free), and distill it down to one single meeting that lays out your process (not your solution) in simple terms, then you will build trust and onboard new clients much sooner than you ever thought possible.

If you're an ambitious advisor, with a defiant streak (following the crowd isn't your thing), who is overly reliant on referrals, with limited time and resources, but willing to grow and challenge your own thinking -- and you'd be happy with 1 – 2 new high-net-worth clients per month...

Then it's time to upgrade your skill set to a "category-of-one" new inbound high-quality sales/lead model (no prospecting), that defies traditional industry thinking and norms...

Get Your Free Book & Free "Get New Clients" Lead Generation Consultation ASAP!

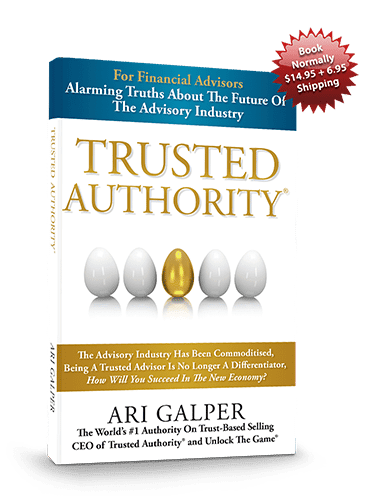

Order the new book “Trusted Authority” below and get a free “Get New Clients” lead generation consultation (value $995).

In this ground-breaking new book, you’ll discover:

- How to create a flow of high-quality leads in the next 90-days by becoming the Trusted Authority in your market

- How to differentiate yourself from other advisors so that your ideal client says “He/she is the one for me…”

- How to re-position yourself to create inbound demand for your ideal clients only becoming a “category-of-one”

- How to create a “by-appointment-only” business so you stop lowering your authority by "chasing” leads

- How to onboard new clients in one single meeting or zoom conversation… yes this is possible!

Meet The Author

Ari Galper is the world’s number one authority on trust-based selling and is one the most sought-after sales conversion experts for Financial Advisors.

He is the creator of Unlock The Game®, a completely new revolutionary sales approach that overturns the notion of selling as we know it today.

Ari has been featured in CEO Magazine, SkyNews, Forbes, INC Magazine and the Australian Financial Review.

His newest book, “Trusted Authority”, has become an instant best-seller among Financial Advisors worldwide.

With clients in over 35 countries, his global sales systems have become the most successful Trust-Based Selling systems of our time.

In a day and age where technology rules the selling world, for many growth-oriented advisors, deep trust has taken a “back seat” to the sales process.

Ari’s personal insights on how to build trust between buyers and sellers continue to break new ground in the financial services industry.

Ari has been on a mission for the last two decades to change the financial services world through trust.

Through his sold-out talks all over the world and his in-house trainings for high-producing advisors, Ari has become the global ambassador to businesses all over the world.

He regularly connects with global business icons and leaders of industries seeking his counsel on how to infuse trust in their organisations and across their teams.

Ari is a true “disruptor” in the financial services industry. He has been endorsed by legendary sales mentors like Brian Tracy who said: “Ari Galper’s trust-based selling approach is the greatest sales breakthrough in the last 20 years”.

Ari’s sales growth consulting firm has a growing waiting list of financial advisors wanting access to his unique Trusted Authority lead generation models and sales conversion strategy advice.

Ari is also the author of “Lessons From Toby”, a special book about his son Toby who has Down’s Syndrome, who has made a major impact on Ari’s approach to teaching authenticity and trust in his Trust-Based Selling approach.