Why Do Financial Advisors Lose 7 out of 10 Sales Opportunities?

In my work with Financial Advisors over the past two decades, I’m still amazed at how many highly qualified new client opportunities seem to “slip through their fingers” – those aren’t my words, those were told to me a few weeks ago by one of our recent advisor clients who came to us looking for sales conversion help.

I don’t know about you, but I wouldn’t be surprised if you averaged between three to five new clients out of ten opportunities.

For most advisors, those conversion rates are cause for celebration.

For the ambitious advisor, they are a disappointment, because more than half of their opportunities are walking out the door.

Think about the difference and the impact you could be making in the lives of those potential new clients who decided not to onboard with you, but instead, chose to go with another advisor.

Look, you could spend more money on marketing to generate more leads, to create more sales opportunities, but is that really the smartest way of thinking?

Why not shift your mindset, and focus only on increasing your conversion rate….plug up the holes in your “bucket” once and for all, so you stop losing new client opportunities.

Can you convert 6, 7, 8, 9, or even… 10 out of 10 qualified opportunities?

You betcha you can.

But you can’t do it if you’re doing these in your sales conversations:

Free Consulting/Education

When your potential prospect presents you with their financial challenges, your instinct is to solve their problem by educating them and showing them a better way…right?

Stop that immediately, it’s killing your conversion rate and probably triggering a lot of “I’ll think about it…” or “I’ll talk to my wife/husband/partner about this and get back to you”.

Relationship Building vs. Trust-Building

Stop trying to build a relationship with your potential clients pre-sale.

Look, the truth is they don’t want to become your friend and they really don’t even need to like you to work with you.

Sure you need to be pleasant and friendly, but if you’re used to “rapport-building” and finding commonalities in the hopes you’ll find a “connection”, you’re sending them down the wrong track.

Multiple Meetings vs. One-Meeting Onboarding

Multiple meetings do not increase trust, they extend your sales process and give your prospect multiple exit points… and they force you to “chase” them by following up.

…If you resonate with any of the above “blind spots”, then maybe it’s time to re-think your sales process.

Here are three recent Financial Advisors, thankful and appreciative for a new approach to their sales and lead generation process — and not having to accept average “industry norms” for how to grow their practices:

If you’re not converting 10 out of 10 qualified prospects, then you’re leaving a significant amount of money on the table.

Do you have qualified prospects who show strong interest through multiple meetings, but end up slipping through your fingers, and never calling you back?

Are you doing "free consulting" and educating your prospects, proving your value, yet you still hear the dreaded: "I want to think about it"?

Are you "following-up" after your initial sales conversations, not getting the response you're looking for, questioning why you even have to "chase" in the first place?

If any of the above applies to you, then Get Your Free Book & "Plug Up The Holes" Consultation

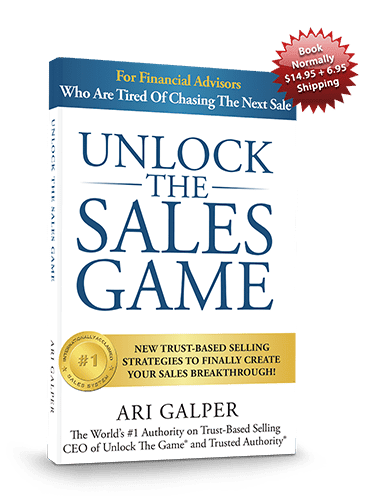

Order the new book “Unlock The Sales Game” below and get a free “plug up the holes” sales conversion review (value $995).

When you order the book, click “Yes, I’d like a complimentary consultation” in the form, and you’ll receive an email to schedule your confidential sales conversion review.

In this ground-breaking new book, you’ll discover:

- How to break the endless cycle of potential clients “shopping” you against other advisors, putting you in a position of having to “prove” yourself

- New ways to get to the truth in your initial sales conversation, so you are selecting them, rather than them selecting you

- The secrets to easily moving the sales process forward without giving away your value or doing “free consulting”

- Why focusing on your prospect’s truth is more important (and profitable) than focusing on making the “sale”

- How to onboard new clients in one single meeting or zoom conversation… yes, this is possible!

Meet The Author

Ari Galper is the world’s number one authority on trust-based selling and is one the most sought-after sales conversion experts for Financial Advisors.

He is the creator of Unlock The Game®, a completely new revolutionary sales approach that overturns the notion of selling as we know it today.

Ari has been featured in CEO Magazine, SkyNews, Forbes, INC Magazine and the Australian Financial Review.

His newest book, “Unlock The Sales Game”, has become an instant best-seller among Financial Advisers worldwide.

With clients in over 35 countries, his global sales systems have become the most successful Trust-Based Selling systems of our time.

In a day and age where technology rules the selling world, for many growth-oriented advisors, deep trust has taken a “back seat” to the sales process.

Ari’s personal insights on how to build trust between buyers and sellers continue to break new ground in the financial services industry.

Ari has been on a mission for the last two decades to change the financial services world through trust.

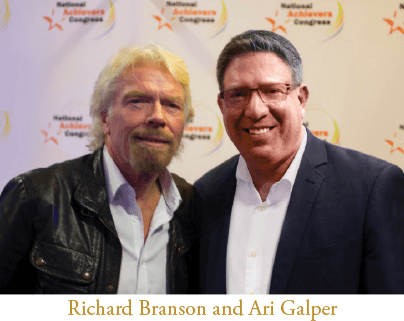

Through his sold-out talks all over the world and his in-house trainings for high-producing advisors, Ari has become the global ambassador to businesses all over the world.

He regularly connects with global business icons and leaders of industries seeking his counsel on how to infuse trust in their organisations and across their teams.

Ari is a true “disruptor” in the financial services industry. He has been endorsed by legendary sales mentors like Brian Tracy who said: “Ari Galper’s trust-based selling approach is the greatest sales breakthrough in the last 20 years”.

His work in the trust-based selling field, focusing on reversing control of the sales process, from buyer to seller, is considered category-of-one thinking, with over a two decades of proven execution and results.

Ari’s sales growth consulting firm has a growing waiting list of financial advisors wanting access to his unique sales growth advice and sales conversion strategies.