How To Avoid Getting “Shopped” Against Other Advisors

When there is an abundant supply of financial advisors in your local market, it becomes harder for you to differentiate yourself.

As a result, it’s easy to let your guard down and adjust your fees downward (or add more pre-sale “meetings” to your sales process), out of fear you might lose a new client opportunity.

But if you allow yourself to become commoditized in this way, you open yourself up to being “shopped” against other advisors.

This is a problem facing many financial advisors, even successful ones.

Your initial meeting with a potential client will go well, but near the end of the meeting they’ll say to you something like: “Thanks for your time but we’re looking at 2 or 3 other advisors and have meetings lined up this week… we’ll get back to you”.

Ouch… you just invested an hour of your time for a “we’ll get back to you”.

Waiting for potential clients to get back to you is no way to build a reliable and consistent business – and being forced to chase them when they don’t get back to you, only pushes them away.

So, what do you do?

Focus on getting to the truth

When a potential client says to you the dreaded phrase “we’ll get back to you”, understand… it’s not about you, it’s about them.

They have been conditioned to believe that solving their problem requires shopping around for different solutions.

The problem is, they aren’t qualified to evaluate any solution… if they were, they could solve their problem on their own.

Subconsciously, they also want to avoid their problem and shopping around provides the perfect distraction.

When they’re in “shopping” mode, you need to call them out, in a refined and delicate way.

After telling you they plan to see other advisors first, you could respond like this:

“May I ask, what is the most important criteria an advisor must have, for you to want to work with them?”

If assessing multiple advisors is a genuine need, shouldn’t they be able to articulate their selection criteria?

I suggest to you, they’ve never even thought about the answer to that question.

Your goal always, is to get to the truth of your potential client’s problem and the reason why they sought your help in the first place.

If solving their problem is not a genuine and urgent priority for them, this simple question will confirm that and allow you to disengage. But if it is a genuine priority, you will have diplomatically shown them that “shopping around” is a waste of time, and brought their focus back to solving their problem with you, assuming you match their criteria.

Remember, your potential client is not interested in how you solve their problem. The main thing on their mind when they meet you is, whether they can trust you to solve it.

Learn how to build trust with your potential clients and dispel any resistance that makes them believe they need to shop around.

Focus on getting to the truth, rather than making the sale.

If you’re not converting 10 out of 10 qualified prospects, then you’re leaving a significant amount of money on the table.

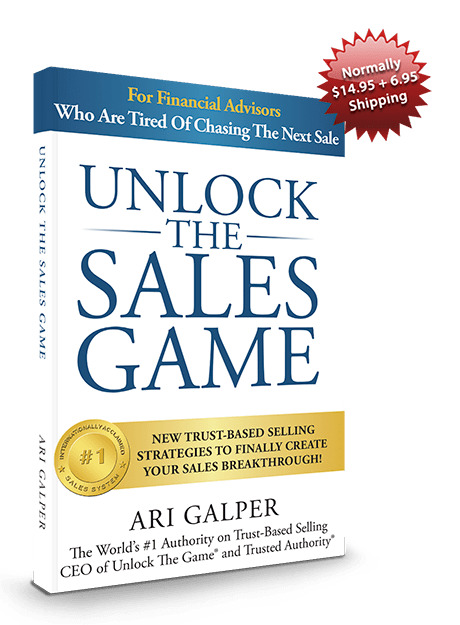

Get Your Free Book Below

Order the new book “Unlock The Sales Game” below and get a free “plug up the holes” sales conversion review (value $995).

When you order the book, click “Yes, I’d like a complimentary consultation” in the form, and you’ll receive an email to schedule your confidential sales conversion review.

In this ground-breaking new book, you’ll discover:

- How to break the endless cycle of potential clients “shopping” you against other advisors, putting you in a position of having to “prove” yourself

- New ways to get to the truth in your initial sales conversation, so you are selecting them, rather than them selecting you

- The secrets to easily moving the sales process forward without giving away your value or doing “free consulting”

- Why focusing on your prospect’s truth is more important (and profitable) than focusing on making the “sale”

- How to onboard new clients in one single meeting or zoom conversation… yes, this is possible!

Meet The Author

Ari Galper is the world’s number one authority on trust-based selling and is one the most sought-after sales conversion experts for Financial Advisors.

He is the creator of Unlock The Game®, a completely new revolutionary sales approach that overturns the notion of selling as we know it today.

Ari has been featured in CEO Magazine, SkyNews, Forbes, INC Magazine and the Australian Financial Review.

His newest book, “Unlock The Sales Game”, has become an instant best-seller among Financial Advisers worldwide.

With clients in over 35 countries, his global sales systems have become the most successful Trust-Based Selling systems of our time.

In a day and age where technology rules the selling world, for many growth-oriented advisors, deep trust has taken a “back seat” to the sales process.

Ari’s personal insights on how to build trust between buyers and sellers continue to break new ground in the financial services industry.

Ari has been on a mission for the last two decades to change the financial services world through trust.

Through his sold-out talks all over the world and his in-house trainings for high-producing advisors, Ari has become the global ambassador to businesses all over the world.

He regularly connects with global business icons and leaders of industries seeking his counsel on how to infuse trust in their organisations and across their teams.

Ari is a true “disruptor” in the financial services industry.He has been endorsed by legendary sales mentors like Brian Tracy who said: “Ari Galper’s trust-based selling approach is the greatest sales breakthrough in the last 20 years”.

His work in the trust-based selling field, focusing on reversing control of the sales process, from buyer to seller, is considered category-of-one thinking, with over a two decades of proven execution and results.

Ari’s sales growth consulting firm has a growing waiting list of financial advisors wanting access to his unique sales growth advice and sales conversion strategies.

© Unlock The Game 2022 · Powered by Unlock The Game®